Step 1 is to forecast the cash flows a company generates from its core operations after accounting for all operating expenses and investments. debt) have been removed.īoth should theoretically lead to the same value at the end (though in practice it’s actually pretty hard to get them to exactly equal). The unlevered DCF approach is the most common and is thus the focus of this guide.

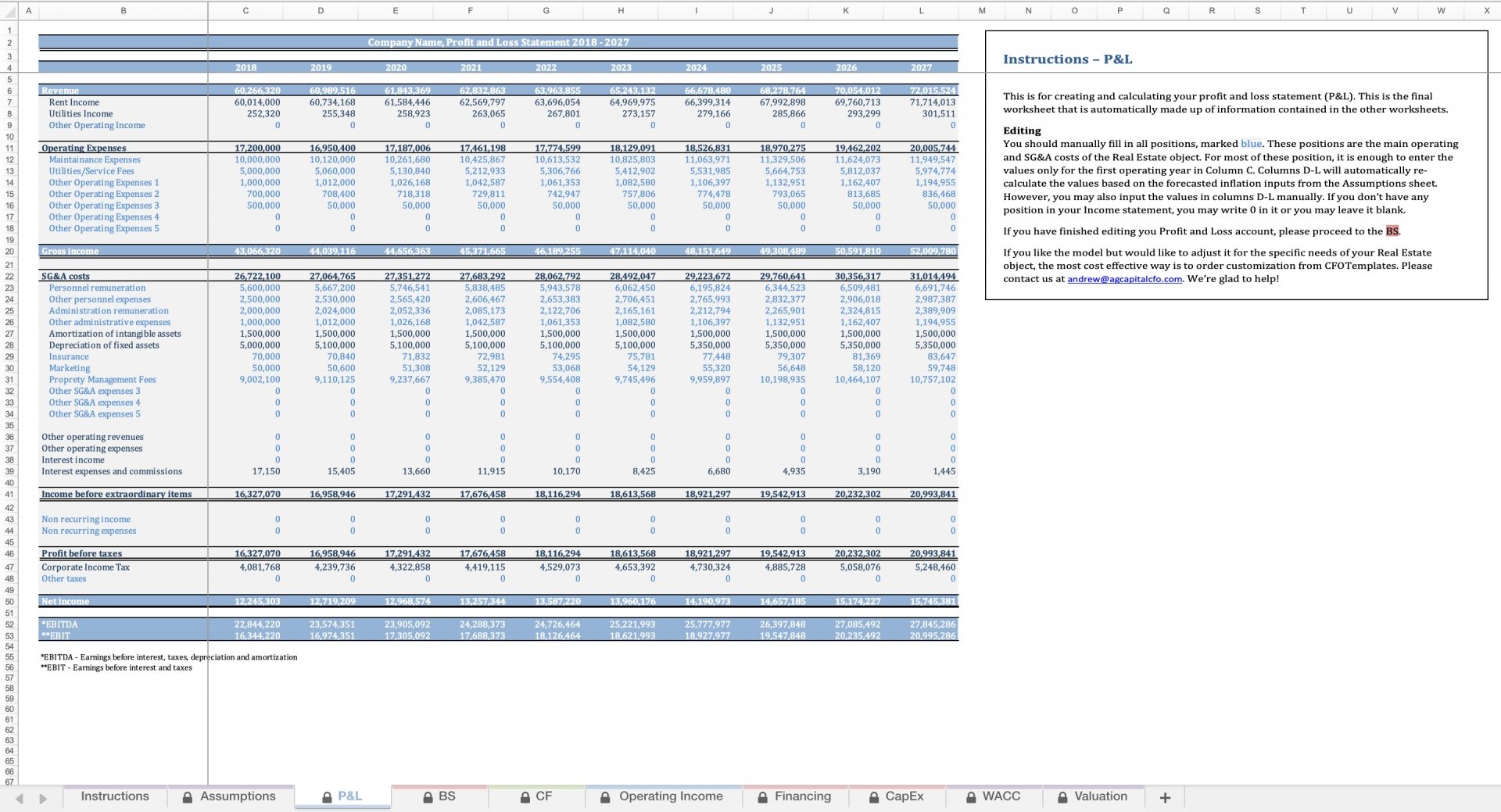

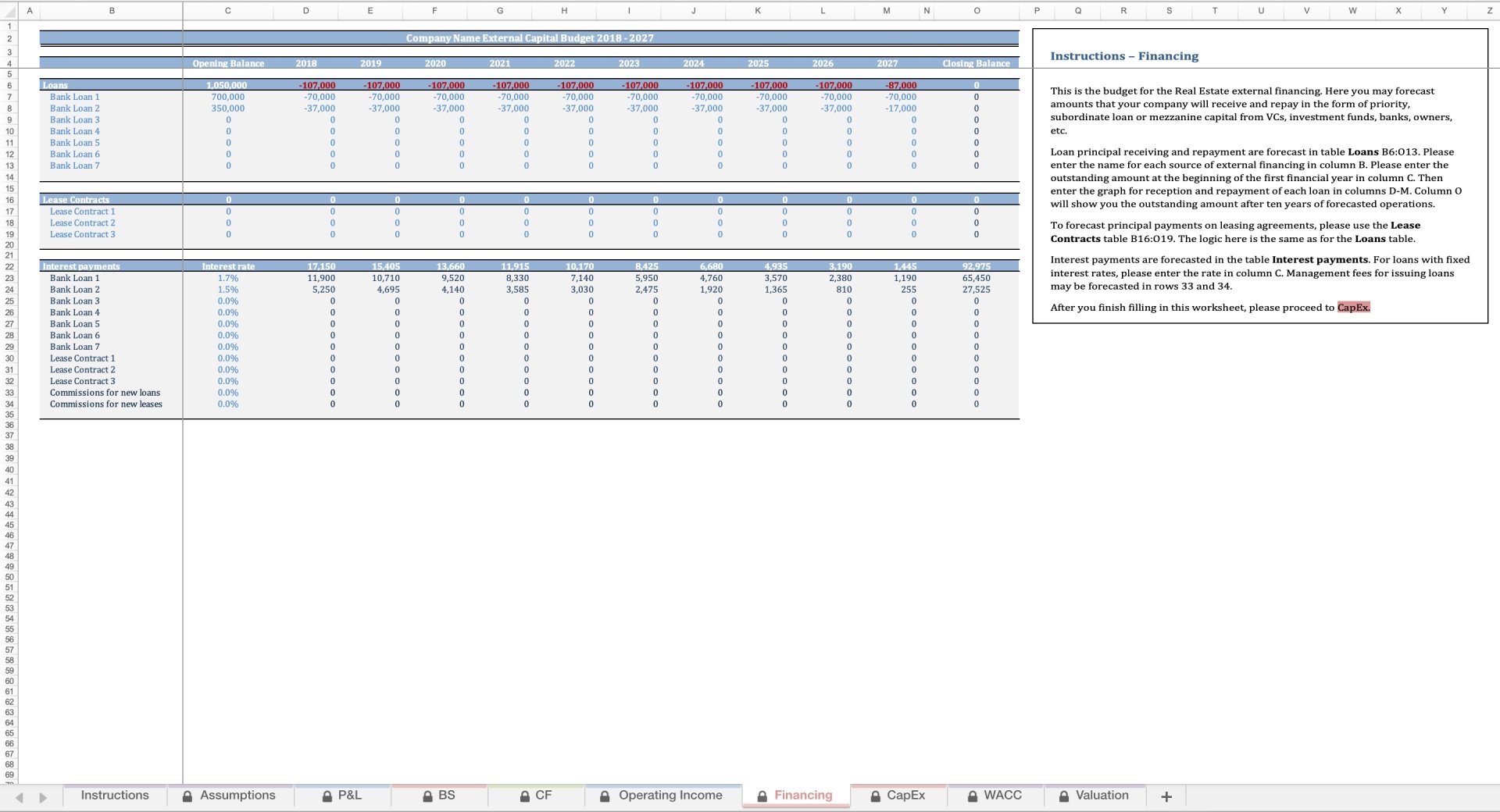

Then, when you have a present value, just add any non- operating assets such as cash and subtract any financing related liabilities such as debt.įorecast and discount the cash flows that remain available to equity shareholders after cash flows to all non-equity claims (i.e. There are two common approaches to calculating the cash flows that a business generates.įorecast and discount the operating cash flows. The premise of the DCF model is that the value of a business is purely a function of its future cash flows. Thus, the first challenge in building a DCF model is to define and calculate the cash flows that a business generates.

#Free property evaluator cash flow download#

Use the form below to download our sample DCF Model: However, if cash flows are different each year, you will have to discount each cash flow separately:īefore we begin … Download the Sample DCF Model In Excel, you can calculate this fairly easily using the PV function (see below). The math gets only slightly more complicated: If I make the same proposition but instead of only promising $1,000 next year, say I promise $1,000 for the next 5 years. So, let’s say you decide you’re willing to pay $800. We can express this formulaically as (we denote the discount rate as r): That present value is the amount investors should be willing to pay (the company’s value). The DCF approach requires that we forecast a company’s cash flows into the future and discount them to the present in order to arrive at a present value for the company.

#Free property evaluator cash flow full#

For that, you can enroll in our full scale modeling course. This guide is quite detailed but it stops short of all corner cases and nuances of a fully fledged DCF model. We wrote this guide for those thinking about a career in finance and those in the early stages of preparing for job interviews. Enroll in Wall Street Prep’s complete DCF Modeling training.From equity value to equity value per share.Getting to equity value: Subtracting debt and other non-equity claims.

Getting to equity value: Adding the value of non-operating assets.Getting to enterprise value: Discounting the cash flows by the WACC.FCFs are ideally driven from a 3-statement model.Calculating the unlevered free cash flows (FCF).Before we begin … Download the Sample DCF Model.

0 kommentar(er)

0 kommentar(er)